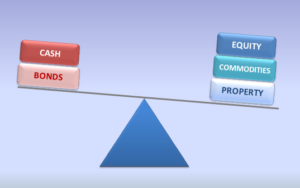

When an investment portfolio is created, it is (or should be) based on the risk appetite and return requirements for that particular investor. For example, an investor approaching retirement may settle on a balanced portfolio of 50% growth assets (equities and property) and 50% defensive assets (bonds, fixed interest and cash) likely to generate mid-range returns with mid range volatility – an appropriate strategy for their personal situation.

However, over time the actual mix of the investor’s assets might stray significantly from their target allocations. Typically this happens as the value of equities and property grows faster than the value of bonds, fixed interest and cash, although it can go the other way too (for example in 2008 when equities all around the world plummeted by 40-50%).

There are two dangerous scenarios when asset allocations move significantly from their targets:

When growth assets exceed the target allocation, the portfolio is likely to experience more volatility than was planned for. This can be highly unsettling for investors, particularly when that extra volatility is in the form of a big downward swing in the value of their portfolio! And it can be risky too. Depending on the investor’s life circumstances, there may not be enough time to recover from negative falls to their portfolio.

The opposite scenario also has downsides. If defensive assets exceed their target allocation (often due to a significant downturn or collapse in equities and/or property), then the returns from the portfolio over the long term are likely to be lower than for an on-target portfolio. This is due to having less growth assets in the portfolio; growth assets should exceed returns from defensive assets over time (but with more volatility).

So to mitigate against these negative scenarios, the solution is to rebalance the portfolio when it strays from its target allocation – if necessary by selling down one asset class, and buying another to return the portfolio to its target allocations.

But how?

There are many different rebalancing strategies. Most are time based (eg. quarterly or annual rebalancing) or threshold based (eg. if assets stray by more than 5% or 10% from their targets), or a combination of the two.

But too frequent rebalancing can be counter-productive, as there are usually costs to rebalance – brokerage costs or bid/ask spreads for buying or selling.

My approach is to use percentage thresholds to trigger a rebalancing signal, and then apply investment wisdom to make final rebalancing decisions. Those decisions may include:

- Hold fire if it seems an asset class is in the middle of a strong upward (or downward) run

- Use portfolio cash flow (new contributions, dividends, interest payments) to fund rebalancing wherever possible

- If selling, make decisions on the particular shares, funds, bonds or properties within that asset class to sell down

- Same as above if buying.

Rebalancing will keep a portfolio on track from a risk (in particular) and return perspective. If done effectively, it’s also a mechanism for achieving the investment holy grail of buying low and selling high.

Dean Edwards