The start of a new decade is always a good time to look back and reflect on what has gone before. From an investment perspective, a decade is also an excellent timeframe to review long term performance of growth assets like shares and property, as it covers a full economic cycle (generally considered to be about 8 years).

The 2020’s was an outstanding decade to be invested in New Zealand equities. The benchmark MSCI New Zealand Index averaged annual gains of 12.8%, while avoiding any scary collapses like what was seen in the previous decade with the global financial crisis in 2008. The worst year was a -5.4% decline in 2015, and the best was 2019 with a 38.8% gain.

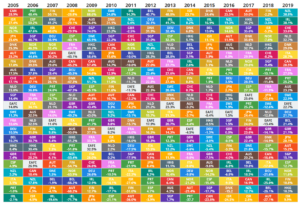

While doing some research for this blog post, I came across the following colour coded chart of annual share market returns – highest to lowest – for developed market countries outside of the US, which goes back 15 years (New Zealand is teal coloured):

International Stock Market Returns

There are a few things worth highlighting:

- The GFC in 2008 was a scary time to be an investor, and thankfully we didn’t see a collapse even remotely close to this during the 2010’s. But it is also instructional to note how markets rebounded from the GFC in 2009. The moral of this story … don’t panic and stay the course.

- Not that we are competitive, but … the New Zealand share market has generally outperformed Australia over the last 10 years, culminating in New Zealand leading the developed world for market returns in 2019! But Australia is still slightly ahead over the full 15 year timeframe of this chart (7.53% v 7.50%).

- As can be seen from the patchwork of colours, relative performance is quite random. As an example, New Zealand went from 2nd bottom in 2017 to 2nd top in 2018! Being well diversified is key as it is near impossible to predict the country winners and losers.

Overall, the 2010’s were a tremendous decade to be invested in equities, and not just in New Zealand. For most of the decade the bulls were in charge, producing stellar long term returns. Bears were rarely sighted, and when they did claw back gains, they didn’t drag markets down too far.

Dean Edwards