A rocky month of October for equity markets has come as a rude wake up call for many investors who had become comfortable with several years of steadily increasing returns.

A rocky month of October for equity markets has come as a rude wake up call for many investors who had become comfortable with several years of steadily increasing returns.

How you feel about your investments during the bad times is often a great way to assess whether you have the right mix of growth and defensive assets in your portfolio.

To illustrate this, consider the portfolio outcomes for and an aggressive investor (100% equities) and a balanced investor (50% equities, 50% fixed interest) during short, medium and long term periods where equity markets fell. This is based on the actual yearly returns of the benchmark US S&P500 Index:

| Investment portfolio performance during the following periods: | Aggressive Investor | Balanced Investor |

| One bad month (October 2018) | -7% | -3% |

| One bad year (2008) | -37% | -18% |

| Three consecutive bad years (2000-2002) | -42% | -20% |

Ask yourself whether you could cope with seeing your investments fall for 3 years in a row, and over 40% in total, which is what happened in 2000-2002? Or if you could handle a 50% drop in 2007/8? (for calendar year 2008 the fall was -37%)

If the answer is no, then you are probably better off having some defensive assets in your portfolio (eg. bonds, fixed interest investments), which usually provide steady returns even when equity markets are tumbling. The above table shows how a balanced investor would have faced losses less than ½ as much as an aggressive investor, during the same negative periods.

For the majority of investors, having some defensive assets in their portfolio helps to cushion the fall during market downturns, plus provides a pool of money that can be used to rebalance a portfolio if indeed equity markets do fall significantly, by buying more equities when they are cheaper.

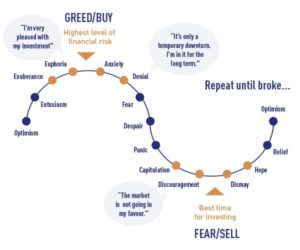

Yes, this approach will come at the expense of greater returns when markets are rising, but if your losses during crashes are not catastrophic, you will feel better emotionally, and you are more likely to stay the course and not panic sell at the worst possible time.

Dean Edwards